What is a broker?

A broker is the middleman between the lender and borrower. A broker will work on your behalf to deal with the banks and other lenders. They will assess your finances, borrowing power and ensure that you get the right loan, which suits your needs.

How much does a broker cost?

A broker often gets paid a fee or commission from the lender for selling their products. Which means in most cases you do not need to pay anything additional as the borrower.

1. More options

We have access to over 40 competitive lenders, from big banks to small credit unions; we are across all the various rates, offers and can help you find multiple loan solutions to suit your financial needs.

2. Expert advice

Our brokers work for you and in your best interest. We will work with you to understand your needs and situation. We will support help you make an informed decision about the best product option and at every step of the way.

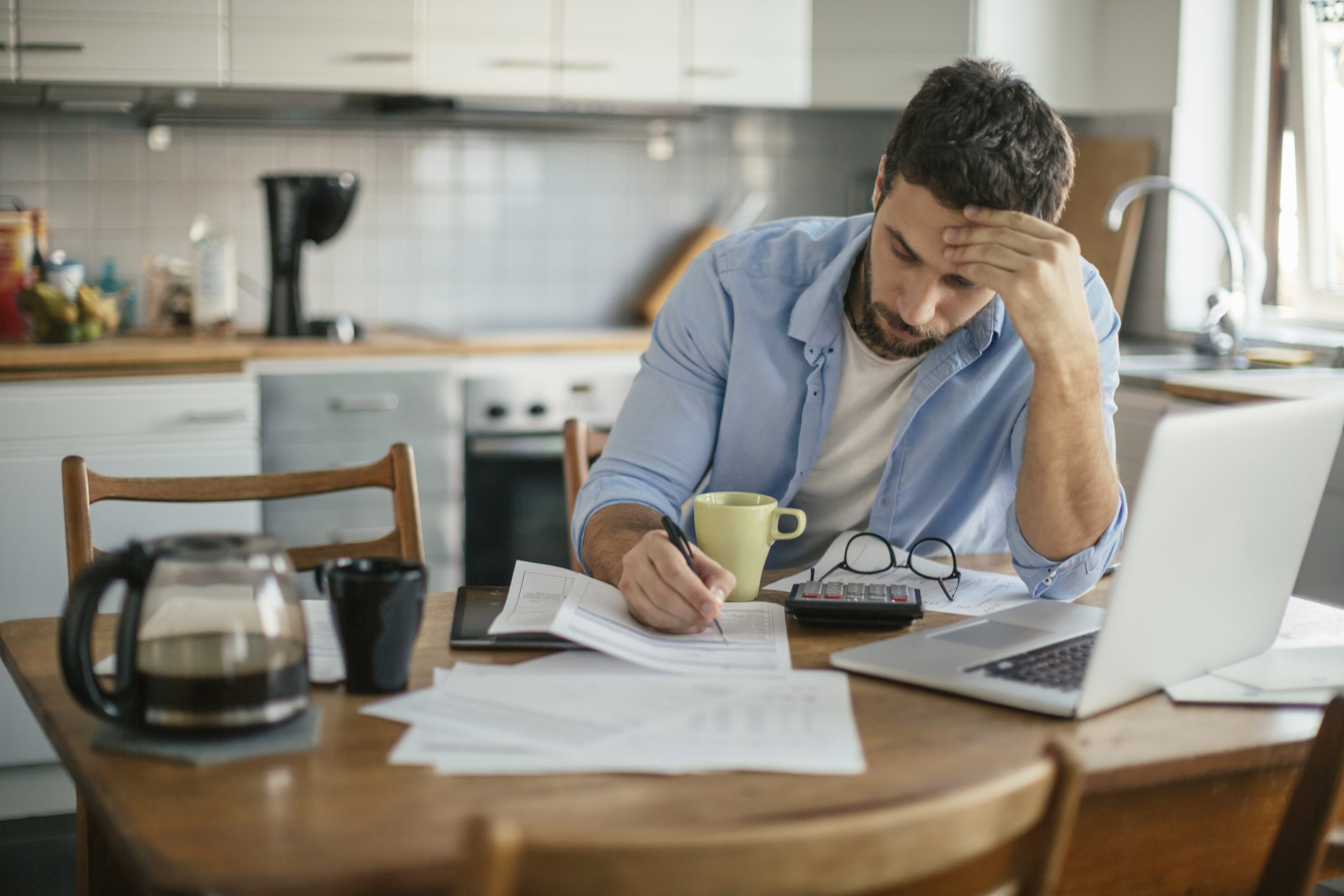

3. Save you time

Looking for a loan can be stressful. There are lots of things to manage including, sorting your finances, shopping around for the best loan to match your needs, managing the paperwork etc. Our brokers can save you a lot of time as they do all the research for you and take care of the entire process on their end.

4. Save you money

By going to the bank directly, you could be missing out on money saving options offered elsewhere. We can source you the most competitive deals and in turn saving you more money.

5. Car Buying service

With access to more than 1300 fleet dealers, we offer car buying services with exclusive discount pricing and tailored finance. No more dealing with a pushy car salesman, we will handle the negotiation process for you to get the car of your dreams at fleet prices.

If you would like to talk to one of our finance experts, call us on 1300 554 553 or contact us via our website. We are here to help.